OTD – January 31 Through February 8, 1958 – Eva Gabor Stars in Noel Coward's Present Laughter – Gabors Galore

Zsa Zsa Gabor's Ninth, Last, and Most Colorful Husband Is Auctioning Off All Her Stuff | Vanity Fair

An Inside Look Into the Tragic Life of Giligan's Island Star Zsa Zsa Gabor | Celebrities, Zsa zsa, Zsa zsa gabor

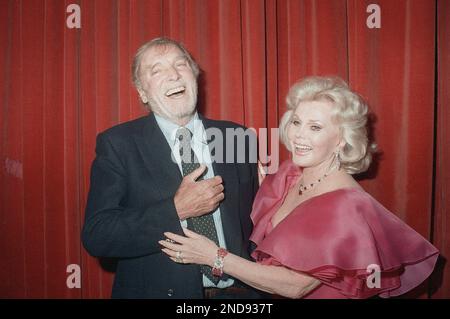

Burt Lancaster and Zsa Zsa Gabor share a laugh in Beverly Hills, California Friday, July 25, 1987 during a photo opportunity prior to an Aid for Aids Awards banquet where Lancaster was scheduled to receive the Man of the Year award in the evening. Ms ...

The Electron Microscope, Its Development, Present Performance and Future Possibilities (Paperback) | Green Bean Books

Jeweler Edwin L. Haasman, right, places a one million dollar necklace with the 90 carat Maja emerald attached, around the neck of actress Zsa Zsa Gabor on Thursday. Nov. 3, 1979 in Los Angeles. Haasman will present his exhibition of fine jewelry in ...

MOVIE PHOTO: Country Music Holiday-Zsa Zsa Gabor-8x10-B&W-Still at Amazon's Entertainment Collectibles Store

:max_bytes(150000):strip_icc():focal(850x0:852x2)/zsa-zsa-gabor-2-2000-3b2de3d94c1b489d911eb7e735541a6b.jpg)