Podkładka żelowa FELLOWES pod mysz i nadgarstek Memory Foam - Podkładki pod mysz i klawiaturę Fellowes - Akcesoria - Ergonomia i akcesoria - Kategorie - Skrzypczak

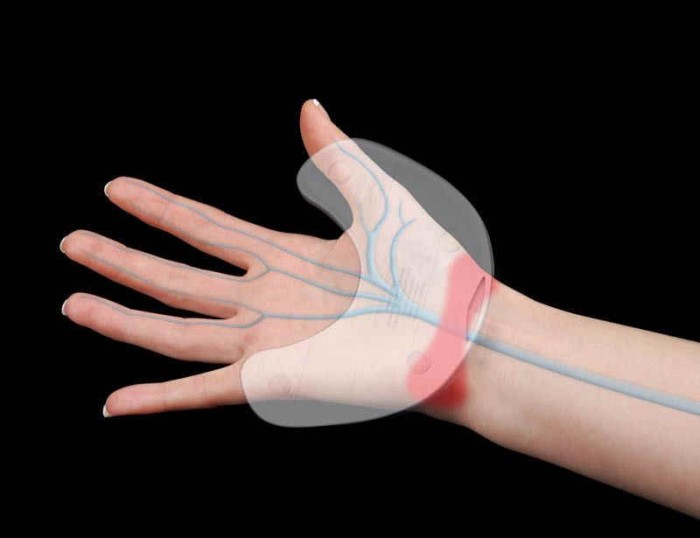

Podkładka żelowa z ruchomą podkładką pod mysz i nadgarstek Health-V Crystal niebieska - Fellowes | Ergonauta.pl

Podkładka żelowa z ruchomą podkładką pod mysz i nadgarstek Health-V Crystal niebieska - Fellowes | Ergonauta.pl

Podkładka pod mysz i nadgarstek Palm Health-V Crystal Fellowes, czarna, 9180701 - Podkładki pod mysz i nadgarstek - opinie i cena - sklep Solokolos.pl